About Milton Berg:

- Milton has worked in the financial services industry since 1978 with an extensive background in various roles on the buy side

- Began as a Commodities Analyst and Trader at Swiss-based Erlanger and Company

- Became a Fund Manager at First Investors Corporation and managed a natural resource fund as well as an option writing fund

- Moved to Oppenheimer in 1984 where he managed three mutual funds which were each ranked as the top performer over a five-year period by Lipper

- More recently, worked with well-known titans of the hedge fund world including Michael Steinhardt, George Soros, and Stanley Druckenmiller (Duquesne)

- He has held a Chartered Financial Analyst designation since 1979

- Named Mutual Fund Manager of the Year in 1987 by The Institute of Econometric Research given his performance during the crash and was jointly named Mutual Fund Manager of the Year with Stanley Druckenmiller that same year by Sylvia Porter’s Personal Finance Magazine

- Milton started his own trading strategy newsletter for institutional clients in 2012, creating a library of thousands of indicators used for timing guidance

About the Model:

The retail model updates daily, and subscribers are provided with the latest status in the monthly newsletter

Special reports are sent to subscribers if the model provides new guidance intra-month

The Investment strategy is straightforward. The model is either 100% invested in the S&P 500 through an ETF such as the SPY or VOO, or 100% invested in cash, such as money-market funds

The model focuses on long-term trends in the market, rather than frequent buy and sell signals

The service is geared to give guidance for investor’s managing their own retirement accounts that want to avoid large drawdowns, and does not provide guidance on individual stocks, and does not use leverage or sell short

There have been 55 round-trip trades in 68 years

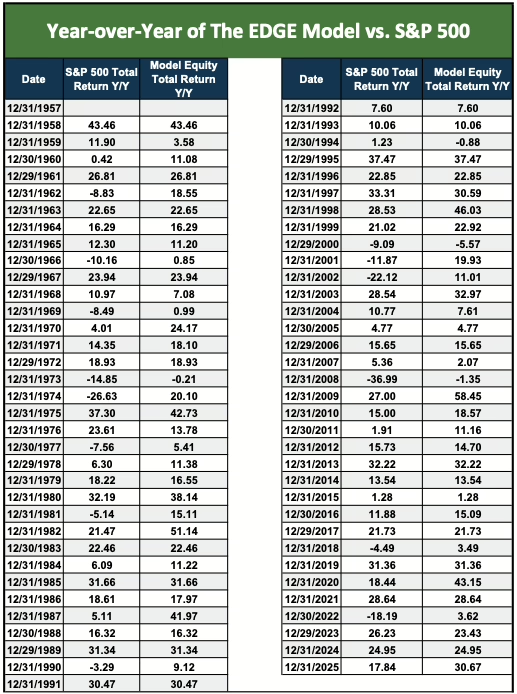

In the double digit down years for the S&P 500 of 1966 (-10.16%), 1973 (-14.85%), 1974 (-26.63%), 2001 (-11.87%) , 2002 (-22.12%), 2008 (-36.99%), and 2022 (-18.19%), this program hypothetically generated returns of +0.85%, -0.21%, +20.10%, +19.93%, +11.01%, -1.35% and +3.62%.

Since October 21, 1957, the theoretical total return for this program has been +18.5% per annum versus the S&P 500 having gained +10.9% total return per annum.

A Model for Long-Term Investing

NOTE: Model returns are hypothetical since 1957. Returns use Total Return (i.e., reinvested dividends) and does not include ETF or other transaction fees.